My mouth was hanging open in shock as I stood at the counter of a gold bullion dealer in Richmond Hill, ON trying to buy a 1oz Maple Leaf gold coin for my daughter to celebrate Chinese New Year.

My mouth was hanging open in shock as I stood at the counter of a gold bullion dealer in Richmond Hill, ON trying to buy a 1oz Maple Leaf gold coin for my daughter to celebrate Chinese New Year.

“$1659?! This is more than I paid for the same coin three years ago! I thought the price of gold was going down?”

“For sure, the price has taken a hard hit by the exchange rate,” the woman behind the counter replied.

I bought a similar coin three years ago for $253 less. The difference is just the fallen Canadian dollar.

The Cauliflower controversy is evidence that gold is not the only commodity affected by the devaluation of the Canadian currency. When my Facebook has become full of mundane grocery shopping experiences gone crazy with the prices of a $9 cauliflower and $21.99/lb yellow chives from the grocery stores it’s evidence the dollar is hitting us hard on a daily basis. .

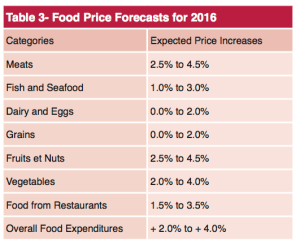

Recent research from Guelph University estimated we can expect a 2 to 4% price increase on fruits and vegetables this year as 81% of these products are imported goods; So, don’t be surprised if you have to pay an extra $325 more per household on food this year.

You can try to stop buying imported goods, purchase only local meats and vegetables or stay in Canada for your next vacation. You can even secure all your savings in the bank and not spend a penny. Your hard-earned money must be protected, right?

That is indeed your wishful thinking…

It’s difficult to save you way to wealth. When you compare your bank balance with your friend in US, you are now 1.5 times poorer. Your friends and relatives in other global cities, for example, in Asia will come visit you more because things are now “cheaper” here. How will you feel when they come to visit and stock up on everything because of the ‘discount’ while you try not to buy anything?

Saving your money as a solution to the falling dollar is going to be slow, painful and quite possible ineffective.

We are in the special time of history where various governments around the world are trying to create inflation to boost their own economy. If governments continue to print money, cut interest rates and devalue their currency, inflation is going to come and at the same time your money is not going to be worth much.

Though hyperinflation is unlikely to happen in Canada, how do we protect ourselves if that does occur? Or, at the least how do we make money in an inflationary environment where our dollar has less buying power?

A typical inflation hedge is hard asset.

Gold is good but you can’t consume it nor does it generate extra cash for you to buy that $9 cauliflower for dinner tonight.

There is a better asset type that would work at the moment in time:REAL ESTATE

Let me highlight the 3 benefits when you use real estate to hedge inflation:

- Hard asset value tends to go up with inflation. In fact, real estate in the Greater Toronto Area appreciated an average of 6% year over year in the last few years according to Canadian Mortgage and Housing Corporation (CMHC).

- The effect of inflation while Canadian dollars is deflating would make your mortgage smaller. Your loan to value ratio decreases when your property value increases and you can now pay your mortgage in lower Canadian dollar price. This becomes more substantial especially if you are currently holding some foreign currencies or assets like gold and silver.

- The extra cash flow from rent can increase your buying power so that you don’t need to worry about the extra $325 you need to pay for foods and you can carry out any cross-border shopping.

Not all Real Estate investments are equal. There are different types of properties like single family, multi-unit, student rental or commercial and strategies such as buy and hold, rent to own, wholesale or flipping that would serve different situations and investment goals.

There are proven systems that can help you create a reliable and sustainable real estate investment portfolio according to your own affordability and goal.

With one of the systems, I was able to get over 100% return with positive cash flow in 3 years using the rent to own strategy without the hassle of dealing with property management and tenants.

If you want to know more about my systems or strategies you can visit www.jonathanchan.ca for more information.